Access Credit Union's 2023 Annual Report and Financial Statements are now available. Learn More.

Statements

Navigating Your Banking Statement

Access Credit Union statements are delivered following the “Relational Statement” model. That means the information presented on your one statement is inclusive and personalized to you, the member, and therefore, based on accounts in which you have an ownership role, including any joint accounts you may be a part of.

When will I receive my statement?

Printed and mailed statements will be mailed within 14 days after month end.

Members can also access their monthly statements using one of the following options:

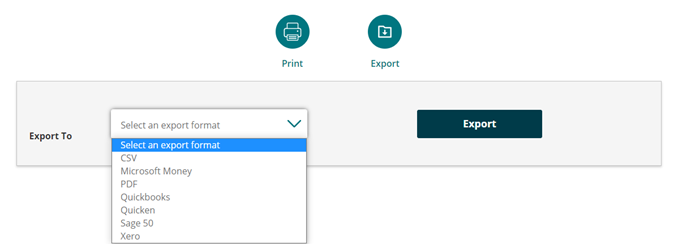

Members can view and export their transaction history from the Transactions area of desktop online banking.

Navigate to Accounts > View Transactions. From there, you have the option to filter the data to select dates or other details.

Branch staff are able to print statements for members, upon request*.

How You Will Receive Your Statement

![]()

“Do Not Mail” offers members the option to pick up their statements from their local branch instead of receiving them via mail or digital delivery. Please contact your branch directly to make these arrangements.

![]()

“e-Statement Only” ensures that statements are received and viewed in online banking only; no statements are printed and mailed. e-Statements are received within 10 days of the previous month’s end. They are stored and archived for up to seven years, ensuring you have easy access to your statements from anywhere at any time.

Please note that all members under the age of 59 with personal accounts and access to online banking are automatically set to receive their statement via e-Statement only.

![]()

"Print & Mail Option" ensures your statement is printed and mailed to your home on a monthly basis. Printed statements are typically received within 14 days of the previous month’s end.

Statement Benefits:

- Each member receives one monthly statement with a summary of all accounts they have an ownership role on, reducing the number of statements required for each account.

- Relational statements are much easier to read and understand because they only contain accounts, investments, and products that you are an owner (or joint owner) of.

- All statements are on a month-end cycle, making it easier to reconcile monthly budgets and expenses for members.

- Savings accounts with interest cycles greater than monthly, including registered variable accounts, will display the accrued interest.

- Registered accounts will display the contract number attached to the account.

- A spousal indicator and contributor name will display on registered spousal plan accounts.

Have a question about your statements?

If you have a question or concern, please reach out to your local branch or contact the Member Solutions Centre at 1.800.264.2926.

Search

Search